October Halloween Sale - MLB Alex Bregman Funko Pop! Vinyl - Surprise:£9

£13£9

103

7

数量:

Product Description

October Halloween Sale - MLB Alex Bregman Funko Pop! Vinyl - Surprise:£9 - Funko Sports

Alex Bregmanis is actually a third baseman as well as shortstop for the Houston Astros, he made his initial MLB appeal along with all of them in 2016 against the Nyc Yankees.

The brand new Major League Baseball Stand Out! Vinyl Amounts are here!Alex Bregman is actually right here to join your collection!

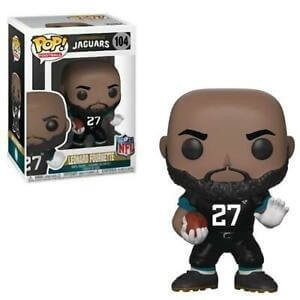

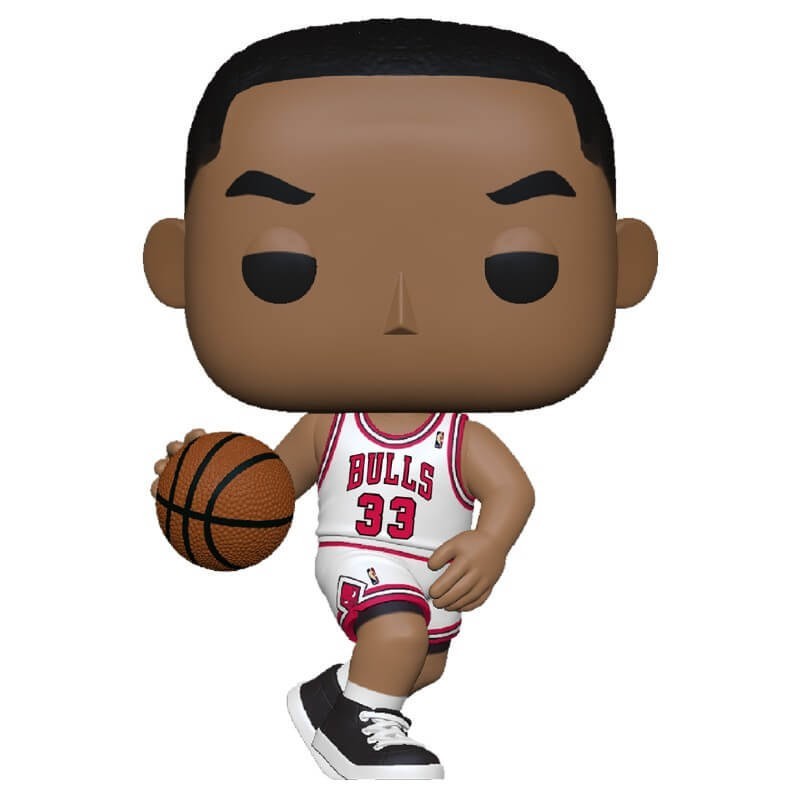

People Also Purch

Product Description

| Status | In stock |

| 送料負担 | $15 |

| Deliver | UPS |

| Ship From | USA |

| Arrived Days | 3-10 DAYS |

| メーカー名 | James |

| メーカー情報 | 株式会社エイ*アンド*アイ〒955-0803 新潟県三条市月岡1-6-12TEL:0256-36-9100 FAX:0256-36-9101 |

Reviews (7)

October Halloween Sale - MLB Alex Bregman Funko Pop! Vinyl - Surprise:£9

October Halloween Sale - MLB Alex Bregman Funko Pop! Vinyl - Surprise:£9