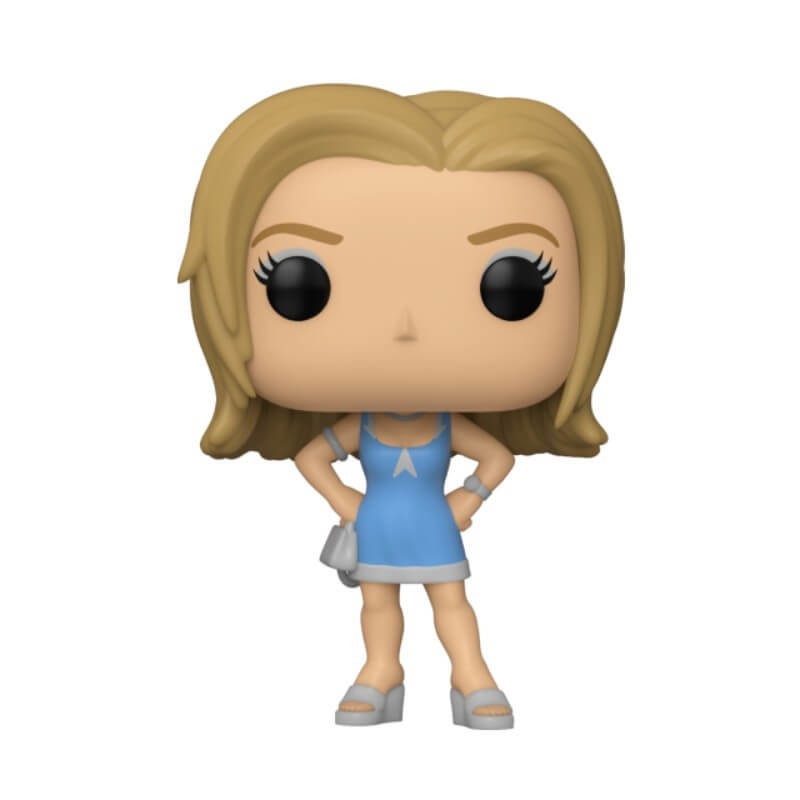

Independence Day Sale - Little Shop of Horrors Audrey II Funko Pop! Vinyl - Clearance Carnival:£9

£13£9

252

12

数量:

Product Description

Independence Day Sale - Little Shop of Horrors Audrey II Funko Pop! Vinyl - Clearance Carnival:&poun - Funko Movie

Experience the cult classic stone musical with this Little Shop of Horrors Stand Out! line! Standing up concerning 3 3/4- ins tall, this Audrey II amount is actually packaged in a home window screen container as well as stands up approx.

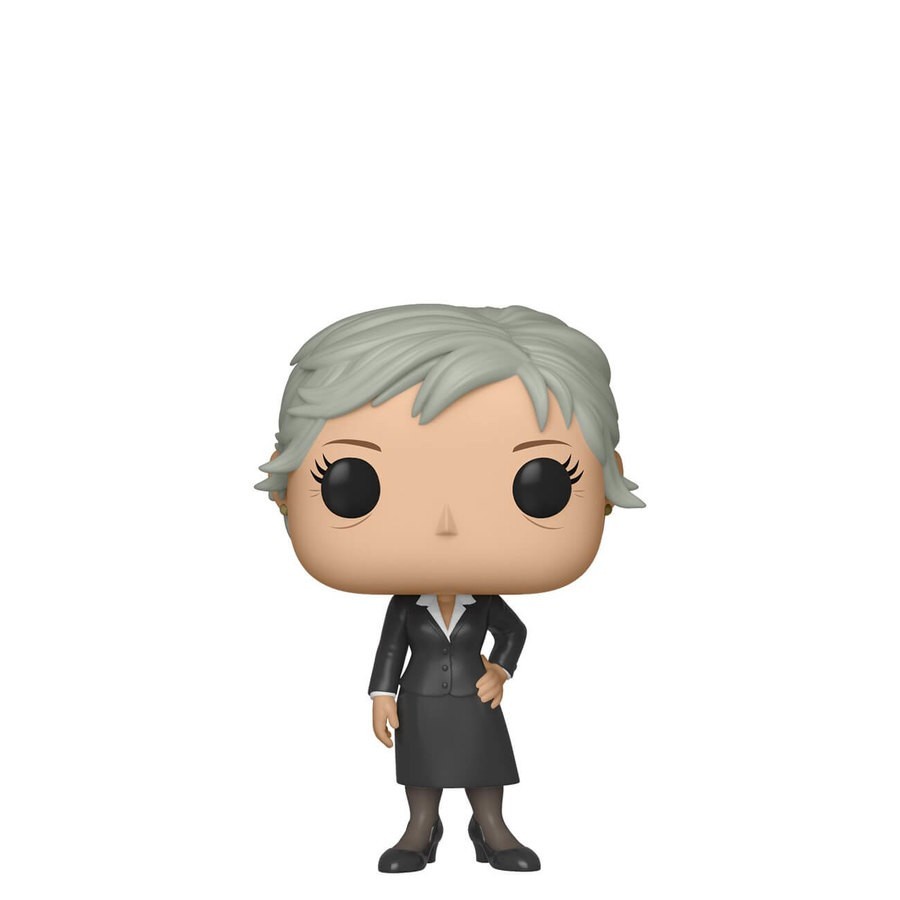

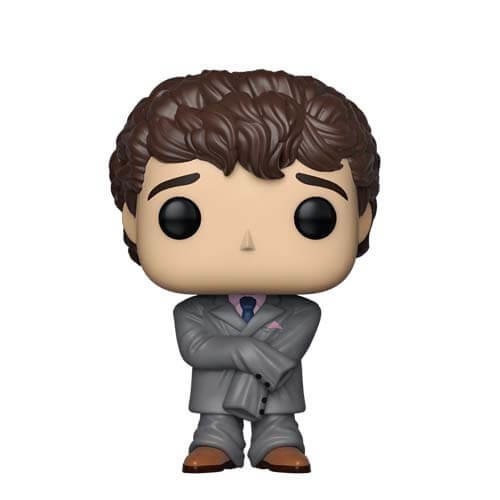

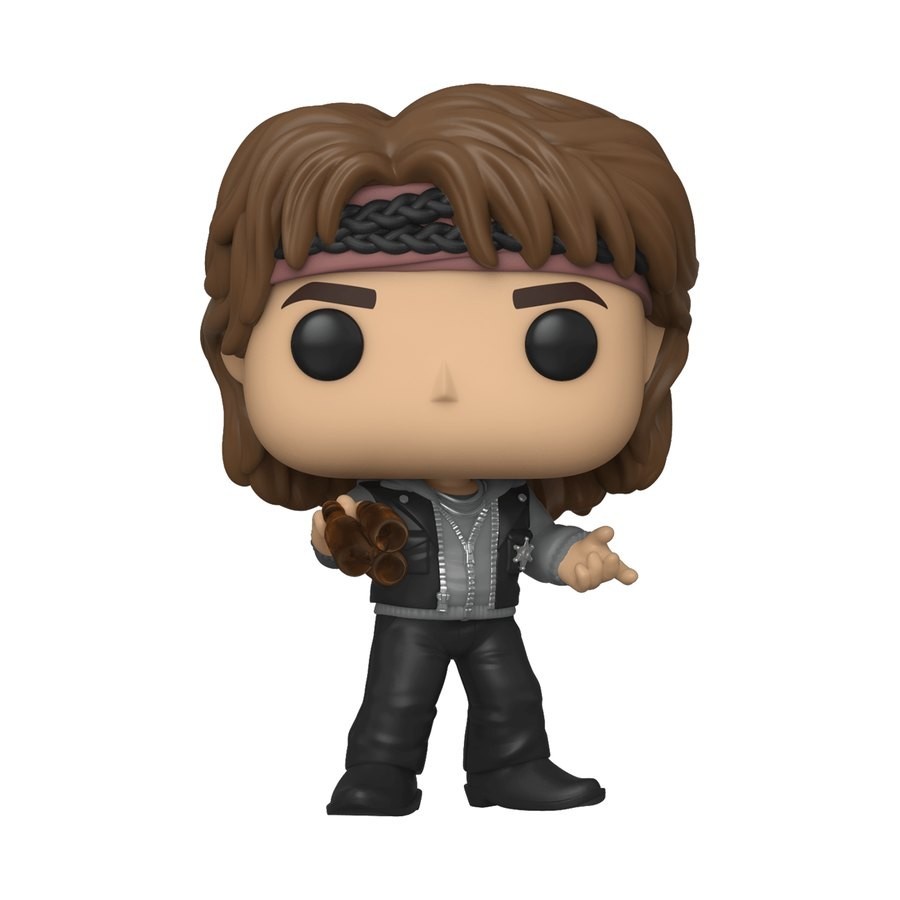

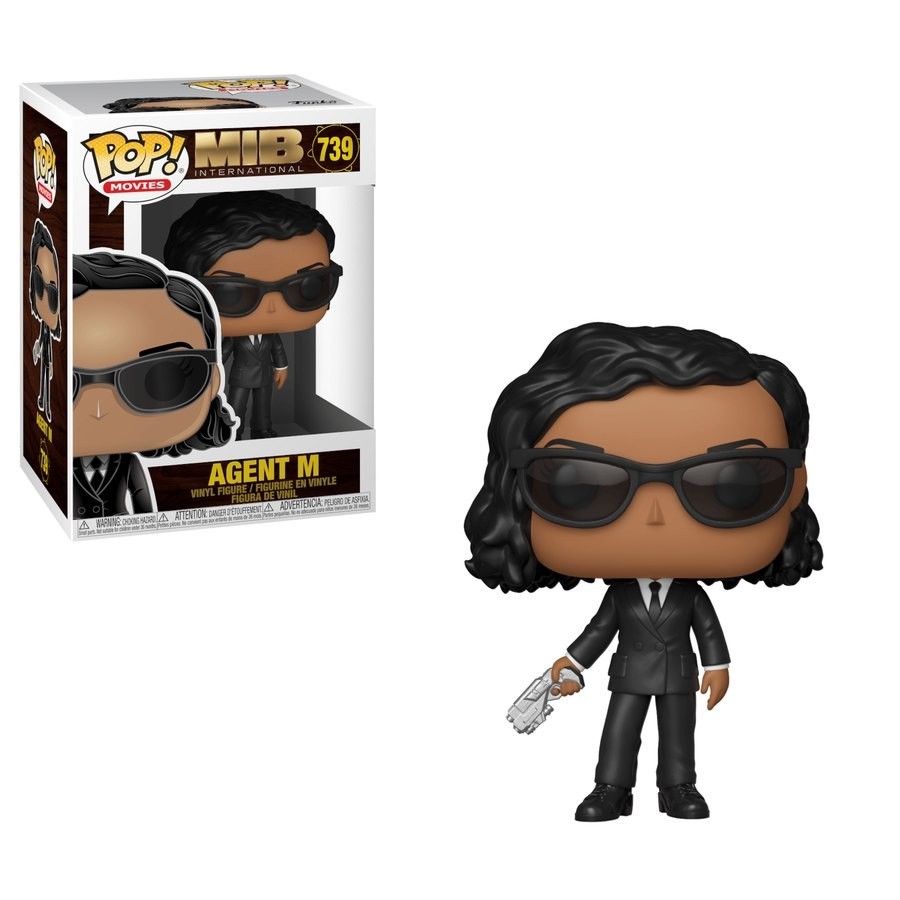

People Also Purch

Product Description

| Status | In stock |

| 送料負担 | $15 |

| Deliver | UPS |

| Ship From | UK |

| Arrived Days | 3-10 DAYS |

| メーカー名 | James |

| メーカー情報 | BIKI-SHOP〒1360071 東京都江東区亀戸2-33-7-203TEL:0363366762 FAX:0363366762 |

Reviews (12)

Independence Day Sale - Little Shop of Horrors Audrey II Funko Pop! Vinyl - Clearance Carnival:&poun

Independence Day Sale - Little Shop of Horrors Audrey II Funko Pop! Vinyl - Clearance Carnival:&poun